A-Life Protect Term is a term life insurance product from AIA Malaysia. Red Cover insurance agents can give you the best quotation for this.

Click the button below to contact AIA Insurance Agent Levine Lee, to answer your questions on this insurance plan.

Or send in enquiry. We will contact you to create the best insurance quotations to fit your term life insurance plan needs.

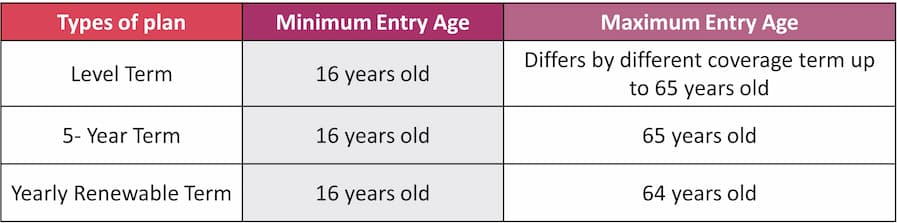

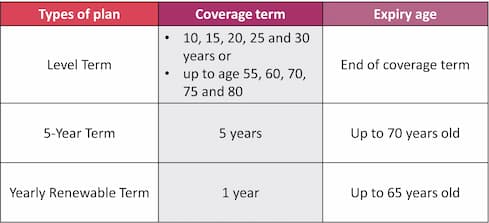

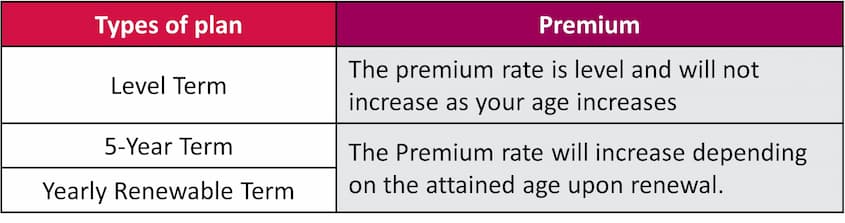

A-Life Protect Term can be purchased for a set of time. AIA will offer you 3 types of plans. Firstly, level term secondly, 5-year term, and lastly, yearly renewable term. Moreover, it provides a variety of protection options to match your needs. Let’s begin by finding the optimum coverage term for your protection requirements.

The minimum sum assured is RM 25,000 while the maximum sum assured is subject to underwriting.

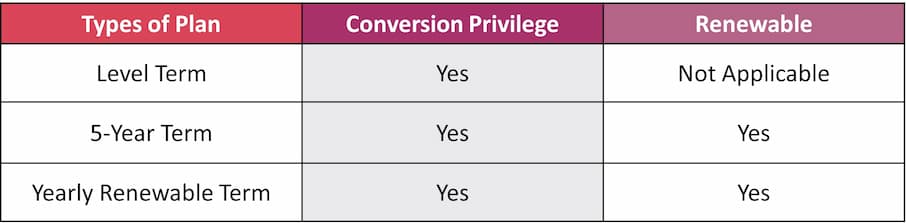

Can the term plans be renewed or converted?Conversion Privilege

•A-Life Protect Term can be switched to another permanent plan (but not for critical illness plans) without any extra underwriting before the insured’s 65th birthday while the plan is still in force.

.The sum assured to be converted must be equal to the policy’s sum assured and must not be less than RM 25,000. Acceptance is also contingent on the new policy’s maximum entry age.

Guaranteed Renewable

• 5-YearTerm can be renewed at the expiry of the 5th policy year without further underwriting.

• Yearly Renewable Term can be renewed at the expiry of every policy year without

further underwriting.

Below is the summary of these benefits

Annual premium rate (per RM 1,000 sum assured) for standard life, male, non-smoker, occupation class 1;

The premiums for this plan are guaranteed.

What are the fees and charges that I have to pay?There are no fees and charges other than the premium payable.

Are the premiums paid for this policy eligible for income tax relief?Yes, based on the end judgment of the Inland Revenue Board of Malaysia, the premiums paid for this plan may qualify you for personal tax relief of up to RM 6,000 for annual life insurance products and EPF.

Levine Lee has over 18 years of working experience with AIA and ING Insurance as an AIA life insurance agent and life planner. Jeffrey Teoh has over 10 years of distinguished working experience with the best group insurance company in Malaysia, including Allianz. And Colin Chow is a trusted Great Eastern insurance agent with over 13 years of experience in the industry.

Contact AIA INSURANCE AGENT LEVINE LEE, at +6012 684 0948. She is the focal point for initial customer contact. Jeffrey Teoh, Colin Chow, or other Red Cover insurance team members will step in to contact you depending on your insurance requirements.

Levine and her team can work with you to create the best insurance proposal and quotations to meet your needs and budget plans within Malaysia. The team can get you quotations from various Insurance Companies in Malaysia for your personal, life, general, group, and business insurance needs.

Send in the form below for your requirements.

" * " indicates required fields

At Red Cover Life Planning, we emphasize our people- helping them grow, expanding their abilities, and discovering new opportunities. Join us now to be part of our team and story.